With this post, number five in a series translated from the Swedish book “Säkra företagets flöden”, I am nearing a conclusion. I found the book by accident when reading a PhD thesis on supply chain risk from Sweden. There will be three more posts, including this one, seven in total. Previously, I portrayed the different categories of buyer-supplier relationships, and how they influence supply chain disruptions. Today I will look at sourcing strategies and how to or may how not to source.

With this post, number five in a series translated from the Swedish book “Säkra företagets flöden”, I am nearing a conclusion. I found the book by accident when reading a PhD thesis on supply chain risk from Sweden. There will be three more posts, including this one, seven in total. Previously, I portrayed the different categories of buyer-supplier relationships, and how they influence supply chain disruptions. Today I will look at sourcing strategies and how to or may how not to source.

Many suppliers – many relations – many strategies

Most companies rely on on a relatively large number of supplier, with whom they form many kinds of relationships, cooperation and transactions.

Multiple sourcing

Multiple sourcing implies buying from three or more suppliers. Typically this may be non-strategical items or office supplies, where the employees are given the freedom to choose a supplier of their liking. Sourcing strategical items from more than one or two suppliers is not recommended, unless the company is in a transition phase and considering replacing some its suppliers, and hence testing the supplier market in order to see who can perform better than the other.

Dual sourcing

Many companies apply dual sourcing, buying from two suppliers. The driving force is that both suppliers have to compete against each other.

Double sourcing

Using two suppliers, both will attempt to become the preferred supplier, thus maximizing quality delivered from the supplier and minimizing costs to the buyer. For instance, one option could be to have a supplier in China for low-cost mass-produced components and a supplier in Europe for high-end low-volume components.

See-saw sourcing

As the name implies, this type of sourcing uses the see-saw principle to distribute contracts in an uneven manner, say 70/30, with both suppliers competing for next year’s (or so) contracts, such that if the supplier with the lesser volume performs better than the supplier with the larger volume, next time that supplier will be awarded with 70%.

Parallel sourcing

Both double and parallel sourcing implies that a the same required product or volume is split between two suppliers. Parallel sourcing implies that sometimes one supplier is used for a component of a model at one assembly plant while another supplier is used at a different plant. Parallel sourcing can also mean sourcing more than one required product or volume from the same supplier. This eliminates quality or performance differences between suppliers for different components.

Single sourcing

Single sourcing was once hailed as the ultimate sourcing strategy since buyer and supplier enter a very close long-term relationship, where they rely upon and support each other. However, as the Nokia versus Ericsson fire incident showed, it can be disastrous.

Societal/political-related monopoly or sole sourcing

Sometimes, for political or legal reasons, one company is given monopoly for the distribution of a certain good, e.g. water or power supply. Here, the buyer will have little or no choice and little or no buying power that enables discounts or advantages compared to other customers.

Market-related monopoly or sole sourcing

Market-related sole sourcing can have several causes. One reason could be the company procurement policy that (for whatever the reason may be), effectively rules out all but one supplier. Another reason is when the buyer company willingly or not (in most cases: unwillingly) sets up technological barriers (due to their choice of production processes or market segment) that bar all but one supplier. Instead of seeking competition leading to development and alternative solutions, the company has remained passive, which in turn may have been exploited by the supplier, making it a secure source of income, since the buyer has no other alternative.

Direct single sourcing

One way to make critical supplies less critical is direct single sourcing. Here, the buyer and supplier enter a business partnership or strategic alliance, or maybe a simple operational alliance with a set goal or even a planned termination.

Conclusion

There are many ways a company can enter a buyer-supplier relationship, and all strategies have their distinct advantages and disadvantages. Whichever strategy is chosen may also depend heavily on the industry sector the company operates in.

More often than not, a large part of company procurement will end up with a small number of suppliers, often termed strategic supplier partners or strategic suppliers, but not always treated as strategic suppliers. Rather, they are treated and exchanged like regular suppliers in free competition. In terms of bringing down costs, this may be a good strategy.

Related

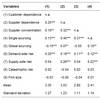

This article will tell you how to calculate the risks and benefits of different sourcing strategies, while this article will show how to visualize the risks of global sourcing.

Reference

Giertz, E., et al. (1999) Säkra företagets flöden, Silfgruppen, Stockholm. ISBN 91 7097 056-4

Related

- husdal.com: How to secure your supply chain – 1/7

- husdal.com: How to secure your supply chain – 2/7

- husdal.com: How to secure your supply chain – 3/7

- husdal.com: How to secure your supply chain – 4/7

- husdal.com: How to secure your supply chain – 5/7

- husdal.com: How to secure your supply chain – 6/7

- husdal.com: How to secure your supply chain – 7/7