The benefits of global sourcing as part of a firm’s purchasing strategy have been widely discussed in the academic literature, yet so there are few models that provide a comprehensive risk and cost assessment to guide managerial decision-making. A picture says more than a thousand words, and here is one paper that has it all and that literally illustrates the differences between different sourcing strategies: On risk and cost in global sourcing by Matthias Holweg, Andreas Reichhart and Eui Hong. The paper defines three basic cost elements in global sourcing: static, dynamic and hidden cost, and uses this framework to assess the costs and risks inherent in global sourcing scenarios from three different points of view: conceptually, analytically and empirically. It is paper shows how brings the message across of where to source and where not to source.

The benefits of global sourcing as part of a firm’s purchasing strategy have been widely discussed in the academic literature, yet so there are few models that provide a comprehensive risk and cost assessment to guide managerial decision-making. A picture says more than a thousand words, and here is one paper that has it all and that literally illustrates the differences between different sourcing strategies: On risk and cost in global sourcing by Matthias Holweg, Andreas Reichhart and Eui Hong. The paper defines three basic cost elements in global sourcing: static, dynamic and hidden cost, and uses this framework to assess the costs and risks inherent in global sourcing scenarios from three different points of view: conceptually, analytically and empirically. It is paper shows how brings the message across of where to source and where not to source.

Global sourcing – a risky venture?

There are many reasons why firms decide to embark on a global sourcing strategy. Lower manufacturing costs being perhaps the prime driver, but as noted by Christopher (2005), it is not without risks. There are indeed many uncertainties and challenges in global sourcing, some of which are mentioned by Sredhar Vedala, the Director of Global Sourcing at EquaTerra, in his piece on the top ten challenges of offshoring. The question is, how can you easily assess the risk of such ventures. Today’s article goes a long way in answering that question.

Three types of costs

The literature on global sourcing is complemented by numerous contributions on supplier selection, but very few authors have proposed comprehensive cost-based decision frameworks for assessing global sourcing decisions. To this effect, the authors propose to distinguish between three basic types of cost in global sourcing: static, dynamic and hidden cost, and they explain what these types of costs are. While not differentiated in a similar manner, many of these risks can also be found in the Gower Short Guide to Procurement Risk, which I have reviewed earlier.

Static costs are the most obvious factor and include unit cost ex-factory, transportation cost and additional customs clearance, insurance or handling charges that might be incurred on a regular basis.

- Purchase price ex-factory gate

- Transportation cost per unit, assuming no unexpected delays or quality problems

- Customs and duty to clear a shipment for export

- Insurance and transaction cost

- Cost of quality control and compliance with safety and environmental standards

- Search cost and agency fees to identify and interact with local suppliers

Dynamic costs capture the fact that the static assessment omits the dynamic dimension of such sourcing decisions, i.e. the fact that supply and demand may vary greatly, and is not always controlled by the manufacturer:

- Increased pipeline and safety stock due, which is amplified by demand volatility and product variety

- Inventory obsolescence due to long logistics lead-times, e.g. in case of quality problems

- Cost of lost sales and stock-outs, as the supply chain is unresponsive to shifts in demand

- Expedited shipments, e.g. air-freight, to ensure uninterrupted supply

Hidden costs are costs that are not related to the actual supply chain operation, but impact on the wider business environment:

- Labour cost inflation due to rising standards of living and competition of the labour market

- Currency fluctuations, in particular for cases of artificially pegged currencies

- Rise in transportation cost, e.g. due to higher oil price and carbon offset costs

- Overhead for managing the international supply base, including travel cost or cost for local personnel in the supplying markets

- The loss of intellectual property to contract manufacturers

- The risk of political and economic instability or change

This is the first takeaway from this article.

Calculations and equations

Obviously, risks and costs can be expressed in numbers and equations, and I will not go to deeply into that, besides referring to one of the equations used for capturing the total cost.

![]()

While it considers static and dynamic costs, it may be less useful for capturing hidden costs. That is the second takeway from this article.

How to decide risks associated with global sourcing?

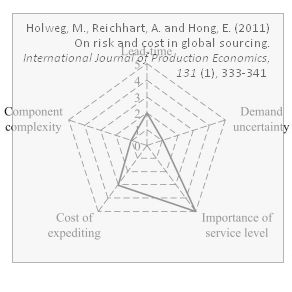

Based on their studies and case examples, the authors contend that there are five key factors which have a significant impact on dynamic (and partly hidden) costs, and thus to a large extent on the risk associated with the economic success of global sourcing decisions:

- the difference in lead-time between the domestic and international supply chain

- the demand uncertainty for the components (often driven by their product variety)

- the importance of service level (or the cost of lost sales and obsolescence)

- the cost of expediting shipments, and

- the product complexity (in terms of its technological sophistication or its need to be manufactured to customer specifications).

In order to compare these factors, a simplified decision framework can be developed for an initial assessment of the risk involved in global sourcing decisions. by ranking each factor on a five-point Likert scale (one being low importance/value/cost and five being high importance/value/cost), giving a picture like the one below:

This way it is actually possible to compare different sourcing scenarios and their associated risks side by side, providing perhaps a much better decision support than verbose analyses and mathematical equations of expected costs and risks. This is the third takeaway from this article.

A three-in-one

This is a complete article, complete in the sense that it covers all three aspects of risk assessment, conceptually, mathematically and graphically. In a way it is bit like a Kinder Surprise or Kinder Egg, which in Norwegian TV commercials is portrayed as being a three-in-one, a surprise (a mental reward), a toy (a mental challenge), and a chocolate (a bodily pleasure), and in Norwegian daily speech, a project having more than one benefit is often termed a “Kinder Egg project”. The analogy is perhaps not perfect, but to me this is a “Kinder Egg article”.

This is a complete article, complete in the sense that it covers all three aspects of risk assessment, conceptually, mathematically and graphically. In a way it is bit like a Kinder Surprise or Kinder Egg, which in Norwegian TV commercials is portrayed as being a three-in-one, a surprise (a mental reward), a toy (a mental challenge), and a chocolate (a bodily pleasure), and in Norwegian daily speech, a project having more than one benefit is often termed a “Kinder Egg project”. The analogy is perhaps not perfect, but to me this is a “Kinder Egg article”.

An argument for sustainable supply chains?

What strikes me with this paper is the conclusion, making a case for global sourcing being far less advantageous than many think, and that many companies willingly or negligently ignore the hidden costs of global sourcing.

Many global sourcing ventures do yield less than expected benefits – or are in fact not economically viable – due to unforeseen hidden and dynamic costs that had not been accounted for in the initial calculations, a fact that was vividly illustrated in our case studies. To this effect, we have proposed both an analytical model that allows for quantifying the static, dynamic, and to a limited extent also the hidden cost of global sourcing, and have proposed a perception-based decision support tool that captures these risks in the absence of precise cost estimates. Combined these tools will give the management much stronger conceptual and analytical guidance to improve global sourcing decisions, and thus help reduce future failures of such ventures.

That said, I personally think that the tools proposed in this paper are the right way of truly assessing the risks and benefits of global sourcing, and thus providing the the basis for the right rather than the wrong global sourcing.

Reference

Holweg, M., Reichhart, A., & Hong, E. (2010). On risk and cost in global sourcing. International Journal of Production Economics, 131 (1), 333-341 DOI: 10.1016/j.ijpe.2010.04.003

Author links

- researchgate.net: Matthias Holweg

- linkedin.com: Andreas Reichhart

- unknown: Eui Hong

Related posts

- husdal.com: Outsourcing – risking it all?

- husdal.com: Dual, single or multiple sourcing?

- husdal.com: The top ten challenges of offshoring