The other day I wrote about supply chains and disasters. Today I will deal with something that is much less catastrophic and write about supply chains and glitches. However, to the shareholders, a supply chain glitch may be just as disastrous (pun intended) as a supply chain disaster. In The effect of supply chain glitches on shareholder wealth from 2003, Kevin B Hendricks and Vinod R Singhal investigate the shareholder wealth effects of supply chain glitches that resulted in production or shipment delays, using a sample of 519 announcements made during 1989-2000. Here they find that glitch announcements on average decrease shareholder value by near 11%. How did they arrive at this value?

The other day I wrote about supply chains and disasters. Today I will deal with something that is much less catastrophic and write about supply chains and glitches. However, to the shareholders, a supply chain glitch may be just as disastrous (pun intended) as a supply chain disaster. In The effect of supply chain glitches on shareholder wealth from 2003, Kevin B Hendricks and Vinod R Singhal investigate the shareholder wealth effects of supply chain glitches that resulted in production or shipment delays, using a sample of 519 announcements made during 1989-2000. Here they find that glitch announcements on average decrease shareholder value by near 11%. How did they arrive at this value?

Reliable and responsive supply chains add value

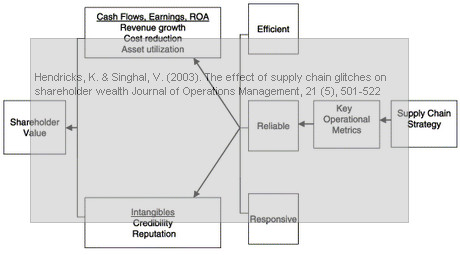

Shareholder value is created how? Obviously, a company must make profit (or have the potential to make profit) in order for the shares to increase their value. And how does the company make profit? Well, obviously again, by having a supply chain that delivers what and when it is supposed to deliver.

Supply chains create value by being reliable and responsive in matching demand and supply. Reliability is delivering the right product in right quantity at the right time to the right place at the lowest cost. Responsiveness is the ability to respond quickly to changing market conditions. One approach to estimating the value creation potential of supply chains is to identify a set of firms that have improved the reliability and responsiveness of their supply chains, and compare their stock price performance against a set of firms that have not improved the reliability and responsiveness of their supply chains. The difference in stock price performance, appropriately adjusted for industry and market performance, provides an estimate of the value creation potential of reliable and responsiveness supply chains. An alternative approach is to estimate the shareholder value lost, if any, when supply chains are unreliable and unresponsive.

Since the former approach is not an easy task, the authors attempt to find unreliable supply chains by looking for company announcements suggesting that a glitch has happened, because unreliable and unresponsive supply chains are more likely to suffer from glitches in matching supply and demand than reliable supply chains. I can agree with that.

Supply chain glitch defined (or not)

So, what exactly is a “supply chain glitch”?

Glitches could be due to many reasons including inaccurate forecast, poor planning, part shortages, quality problems, production problems, equipment breakdowns, capacity shortfall, and operational constraints. Glitches could be due to suppliers, customers, or internal sources.

Fine, but there’s still no definition of a glitch. Is it just some minor malfunction as the word suggests, or does it include a major disruption?

Our focus is on glitches that resulted in production or shipment delays.

Alright. I find that a very vague formulation that does not fully capture the impact of the glitch, which presumably would have some impact on the degree of value loss that a share experiences. A delay of 2 weeks is supposedly less significant than 2 months or 2 years. On the other hand, the fact that a company publicly announces a glitch does suggest some severity. That said, their argument itself is based on sound reasoning:

Glitches do affect a firm’s short- and long-term profitability, which in turn affects shareholder value. By calculating how much shareholder value is lost due to glitches, one can estimate the value creation potential of more reliable and responsive supply chains. The rationale is that if supply chains were more reliable and responsive they would not have experienced the glitches, and hence, would not have experienced the loss in shareholder value.

So far so good. And how do the authors go about calculating the effects of supply chain glitches?

To estimate the shareholder wealth affects, event study methodology is used to compute abnormal returns around the date when information about glitches is publicly announced. Abnormal returns are the difference between the actual change in stock prices and a benchmark to adjust for the overall industry and market-wide influences.

This the authors do for 519 announcements found by searching full text articles in Wall Street Journal (WSJ) and the Dow Jones News Service (DJNS). I’ll skip the mathematics and econometrics, but I’ll discuss some of the results further down this post.

Five hypotheses

The basic underlying assumptions or hypotheses for this research are:

- The announcement of supply chain glitches will have a negative stock market reaction.

- The stock market’s reaction to supply chain glitches will be more negative for smaller firms than larger firms.

- Supply chain glitches by high growth prospects firms will have a more negative stock market reaction than low growth prospects firms.

- The higher the debt–equity ratio, the less negative will be stock market’s reaction to supply chain glitches.

- More recent supply chain glitches will be penalized more by the market than earlier glitches.

The framework for linking supply chain performance with shareholder value is seen in the figure below:

Sources of supply chain glitches

In the 519 announcements, these are the most cited sources for delays. Compare these sources with the standard framework for supply chain risk and you will immediately see a connection here. Behind each answer is the percentage of its occurrence.

- Internal 36

- Customers 20

- Suppliers 16

- Others 5

- Internal and supplier 4

- Internal and customer 1

- Internal and others 1

- Customer and supplier 2

- Supplier and others 1

- None given 16

Interestingly, more than 1/3 of the delays are due to internal sources.

Primary reasons for supply chain glitches

Below are the most cited reasons for delays. Behind each answer is the percentage of its occurrence.

- Parts shortages 24

- Order changes by customer 14

- Ramping up and rollout problems 10

- Quality problems 7

- Development and engineering changes 5

- Production problems 4

- Weather-related problems 3

- Capacity and equipment problems 2

- Information technology problems 2

- Regulatory approval delays 2

- Project and program delays 1

- Constuction problems 1

- Reorganization delays 1

- Cash and financial problems 1

- None given 16

Interestingly, parts shortages are at the top of the list. This is perhaps slightly contradictory to the above, as parts come from suppliers, but together with the above it would suggest that safety stock and inventory issues, not supplier failure is something companies should focus their attention on.

Long-term effects

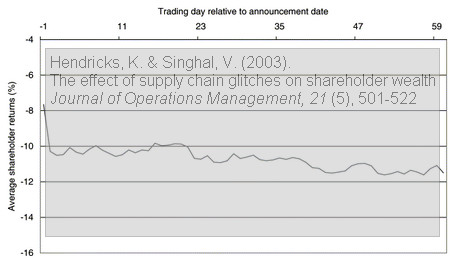

The authors also look at the long-term effect of supply chain glitch announcements. What is apparent is that the largest loss occurs initially, immediately after the announcement. After this the decline continues, but at a much lower pace.

This curve suggests that the effect on the market remains in place even two months after the event announcement. Unfortunately the paper provides little clues as to when the shares start to rise again, i.e. linking a previous negative announcement with a later positive announcement. That would have been very interesting to look further into.

Critique

This is an excellent article that is solidly researched and that clearly links key financial performance indicators with the announcement of supply chain glitches, thus establishing a connection between the reliability of supply chains and their potential for (or against) generating profit. However, the article does have a weak point: The vague definition of “supply chain glitches”. The authors define a supply chain glitch as a supply/demand mismatch resulting in production or shipment delays. A “glitch” in my understanding is something that is easily fixed or that has no serious implications. The fire at the Philips plant that impacted the supply chains of Nokia and Ericsson is no “glitch” in my opinion, but according to this paper it would fall into that category. While others have as classified supply chain events as either one of these three, Deviation, Disruption or Disaster, I am not sure this differentiation would have made any difference in the shareholder wealth impact. It would perhaps have made the message more precise, but not necessarily more accurate.

Reference

Hendricks, K. & Singhal, V. (2003). The effect of supply chain glitches on shareholder wealth Journal of Operations Management, 21 (5), 501-522 DOI: 10.1016/j.jom.2003.02.003

Author links

- wlu.ca: Kevin B Hendricks

- gatech.edu: Vinod R Singhal

Related article

The same research was published in a similar article in another journal, where the focus is more on performance than on shareholder implications. This article provides a more detailed exploration of the data and also a more detailed explanation and discussion of the results:

Hendricks, K., & Singhal, V. (2005). Association Between Supply Chain Glitches and Operating Performance Management Science, 51 (5), 695-711 DOI: 10.1287/mnsc.1040.0353